sports betting in ct taxes

Those numbers will increase with online gaming and iLottery. 12000 and the winners filing status for Connecticut income tax purposes is Married Filing Separately.

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut

Any unpaid taxes will accrue interest.

. According to New York State data mobile sports wagering accounted for 263 million since January 8 and sports wagering at New Yorks four. 24 Tax Withheld. 13000 and the winner is filing single.

The lifting of this prohibition has also provided legal. The lowest rate is 2 whereas the highest is just under 6 at 575. For example if a bettor had 10000 of sports betting winnings in 2020 and 8000 in losses he could deduct the 8000 of losses if he itemized his tax deductions.

Gambling winnings are typically subject to a flat 24 tax. The status of sports betting in Connecticut. Most states allow offshore sports gambling but until recently Connecticut had a prohibition in place for all online gaming.

A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. The state will collect taxes of 18 initially on online. Connecticut was among the early adopters of legalizing sports betting with Public Act 17-209.

12625 and the winners filing status for Connecticut income tax purposes is Single. 24000 and the winner is filing. However for the activities listed below winnings over 5000 will be subject to income tax withholding.

How much revenue will CT sports betting generate. Any other bet if the proceeds are equal to or greater than 300 times the wager amount. Connecticut raked in more than 4 million in revenue from its nascent online gambling and sports wagering industry in November the first full month of legalized betting.

Thats good for an effective tax rate of 125 which matches the states bifurcated tax rates of 85 on retail betting and 1425 on mobile betting. Connecticut Sports Betting Gambling Laws. That changed in 2021 when the CT state legislature passed a bill allowing for legal Connecticut sports betting across all fronts - in-person online and mobile.

Online casino games online were a lot bigger than sports betting. Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24. CT sports betting launched Sept.

19000 and the winner is filing head of household. In fact every dollar you win gambling is taxable. This does not explicitly state sports betting but it.

The standard amount withheld by sportsbooks to cover sports betting taxes on wins is 24. Arbitrage betting in CT and taxes- cant write off gambling losses. Sports betting is expected to bring in about 19 million in the first year and 23 million in tax revenue in the second year of the budget.

That isnt the complete list of all gambling winnings that are taxable though. Any lottery sweepstakes or betting pool. Online sports betting followed a couple weeks later in October 2021.

Mohegan Digital took in 123 million in wagers and paid. Each company will pay an 18 percent tax for online gaming revenues during the. Posted by 3 hours ago.

Sports betting in the state of Connecticut includes the Mashantucket Pequot and Mohegan Indians. 19 and the state reported that its tax coffers gained a total of 17 million in about a half-month of betting under the new system on a total of 366 million in wagers. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income exceeds.

NEW YORK WWTI Mobile sports betting was launched in New York in January and since then the state has generated a record-breaking amount of tax revenue. In Maryland there is a gambling winnings tax rate of 875. These rules apply only to casual sports bettors.

Connecticuts tax coffers gained about 25 million from online casino gaming and 17 million from sports betting last month on a total of 4446 million in wagers. May 31 2022 1145 AM EDT. There is also a potential 100000 fine and up to five years in prison for anyone found.

The launch followed a deal on a new tribal gaming compact. So Im looking into arbitrage betting right now that is where you find inefficiently priced bets from the different betting apps and play both sides to guarantee a small. At the statutory rate of 1375 reaching that number would require operators to generate around 180 million in combined revenue annually.

12000 and the winner is filing separately. Connecticut will get its cut of online casino gambling and sports betting. If you win you have taxable income which should be reported when you file your tax return.

Thats the expected amount that will be owed when it comes tax time each year but that doesnt mean its the amount that is actually owed. The total amount owed for taxes on gambling winnings depends on the total amount earned by. The IRS code includes cumulative winnings from.

While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax. 19000 and the. Arbitrage betting in CT and taxes- cant write off gambling losses.

Whether sports betting is legal in the state where you place your bet doesnt matter to the IRS. Online casino gaming and sports betting has been live in Connecticut since Oct. Connecticut adopted emergency regulations Tuesday intended to.

Gambling Tax in Connecticut Gambling income accrued from other sources is subject to the states standard income tax which ranges between 3 and 699 depending on your total annual income. If a bettor cannot pay the taxes owed on time the IRS will garnish the bettors wages. The fiscal note attached to the bill projects as much as 248 million in annual tax revenue from CT sports betting by 2026.

Connecticut sports betting revenue is taxed at 1375. 30 with retail sportsbooks first. Any sports betting earnings that go beyond 600 are expected by the IRS to be reported by the gambler when they file their taxes.

Since the inception of legal sports betting in 2018 the Garden State has collected 1695 million in taxes from 135 billion in sports betting revenues. If youre a pro in the trade or business of gambling as the IRS puts it different rules.

Ct Gaming Interactive And Salsa Technology In Content Exchange Deal Interactive Technology Salsa

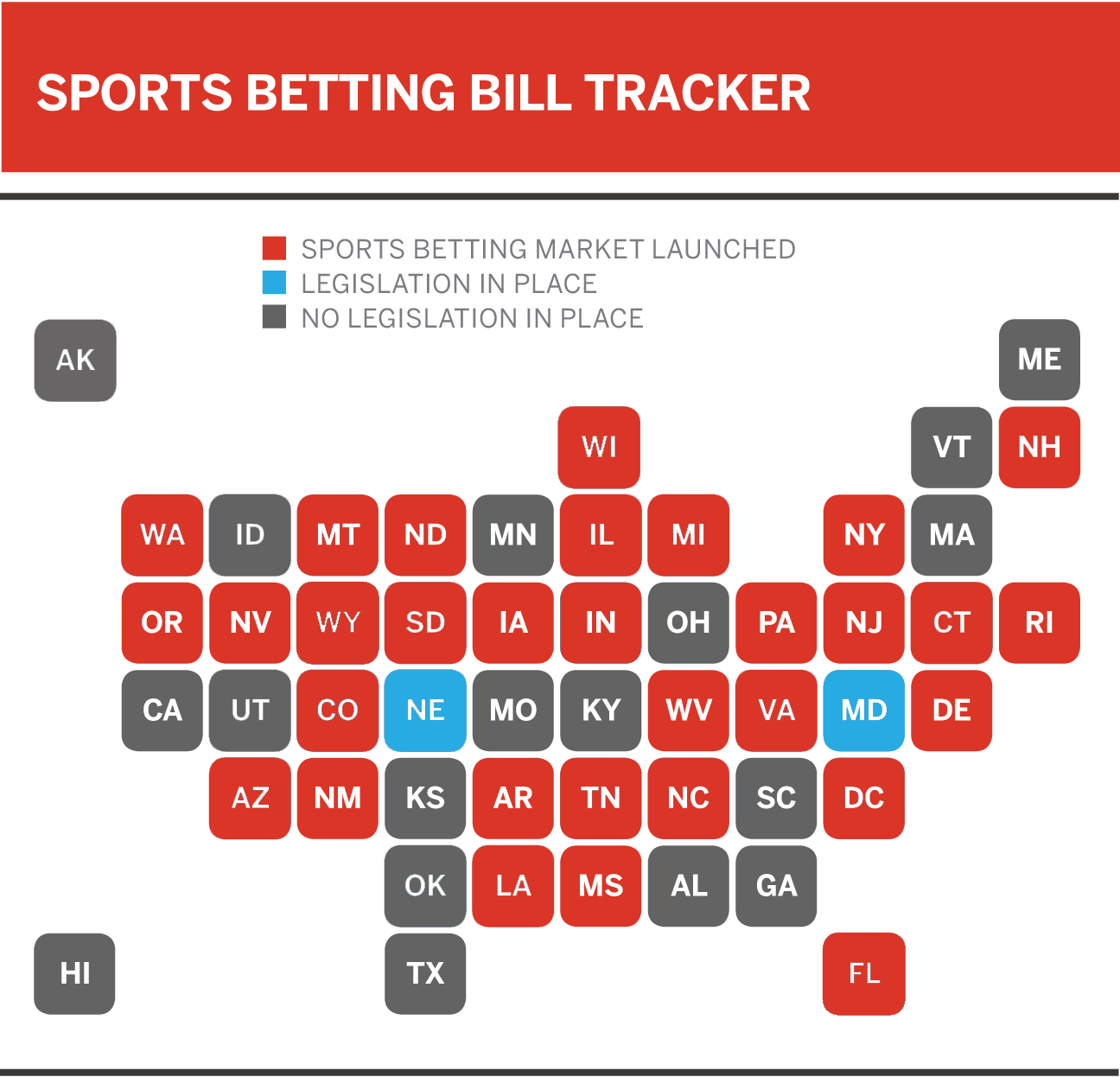

The United States Of Sports Betting Where All 50 States Stand On Legalization

Sports Betting Vs Netflix Which Costs You Less

Before Sports Betting Opens Connecticut Addresses Problem Gambling

Sports Betting Vs Netflix Which Costs You Less

Gambling Pays Out A 38 Billion Bonus To Tax Collectors Winning Lottery Numbers Lottery Numbers Lotto Numbers

Connecticut Betting Sites Legal Online Gambling Apps In Ct

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Connecticut Launches Sports Betting To Modest Crowds

Legal Sports Betting Brought In 4m For Connecticut During Its First Full Month

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Sports Online Gambling To Start In October Ct News Junkie

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Opinion Sports Gambling Is Another Tax On The Poor And Minorities

Sports Betting Vs Netflix Which Costs You Less

As Sports Gambling Grows So Do Appetite Whetting Sure Bets The New York Times

Five Things To Know About Legalized Sports Betting In Connecticut